Despite the massive economic and social disruption wrought by the Covid-19 pandemic in 2020, governments and investors continued to buoy the capital markets. Conscientious investors saw the opportunity to channel their money into funds supporting families and small businesses in crisis. Last year, Natural Investments and our clients held $785M in responsibly managed assets, representing a 21% increase from the prior year.

We directed a significant proportion of our client investments (approximately $541M) toward responsibly managed mutual funds and separately managed accounts that use ESG integration strategies. Applying environmental, social, and governance (ESG) criteria helps us screen out firms with the worst corporate behavior, an approach that minimizes poor performance risk, as shown by numerous studies.

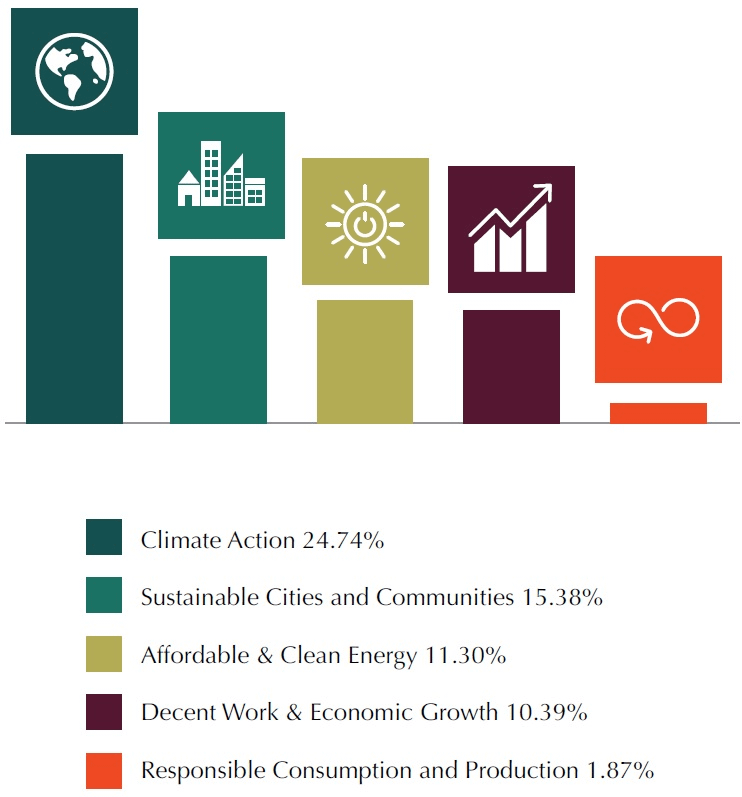

In 2015, the United Nations approved a set of 17 Sustainable Development Goals (SDGs) that serves as a blueprint for ending poverty and other issues that perpetuate inequality and environmental degradation. Many impact investors around the world have followed suit and aligned their mission with the UN SDGs. Natural Investments has achieved the greatest impact in on the following SDGs: Climate Action; Sustainable Cities and Communities; Affordable Clean Energy; Decent Work and Economic Growth; and Responsible Consumption and Production. However, most of our clients want to go beyond screening out the “worst of the worst” corporations on the publicly-traded market. One of the biggest issues discussed in 2020 was the Black Lives Matter protests and the Movement for Black Lives advocacy platform, which urges divestment from exploitive companies that profit from racial and environmental justice, including fossil-fuel companies, weapons contractors, and privately owned-prisons. Many of our clients affirmed their commitment to divesting from companies that directly or indirectly perpetuate systemic racism.

62% OF ASSETS invested in responsible mutual funds and separately managed accounts that utilize ESG strategies. Additional impact asset classes include community investment notes, green bonds, REIT’s, and impact CD’s that support sustainable cities and resilient communities. In addition to mutual funds, Natural Investments sources opportunities in municipal bonds, community investment notes, and other economic development tools that support resilient cities and rural communities. The funding targets areas for infrastructure improvement, affordable housing, clean energy, and small businesses. Stable capital flows help regional economies thrive, which in turn fortifies the overall resilience of the US economy.