It can be overwhelming to think about the ways that our values and

money interact in our lives. Some people might know they want their money to create positive impact but feel unsure of where to start. Unless we bring intention and clarity to our money life, the money flowing through our lives may be fueling human suffering and environmental destruction.

What do we do with this knowledge? If we are able to work on our relationship with money, we can learn to engage with money so that it becomes not just neutral but positive. Money can even become a sacred tool for good if we use it purposefully to support a positive vision—for our own lives and in the bigger world.

INVESTING WITH YOUR VALUES

When it comes to investing with your values, there are four phases. The first phase is awareness. We read, we listen, we watch, and we learn about the power and effect of money in the world. We begin to understand how systems are energized by money flowing into them—and the extractive and exploitive nature of a lot of these systems. We also gain awareness about solutions and the potential for systemic transformation.

The second phase is intention. This is when you focus on your values, your deeper beliefs, and who you are—your spirituality and your faith. The third phase is clarity. This is when you decide how you want to take action and where you want to deepen your relationship between your values and your use of money. And finally, there’s engagement—the phase when you take action and step forward into this area of your money life.

ENGAGING YOUR MONEY FOR GOOD

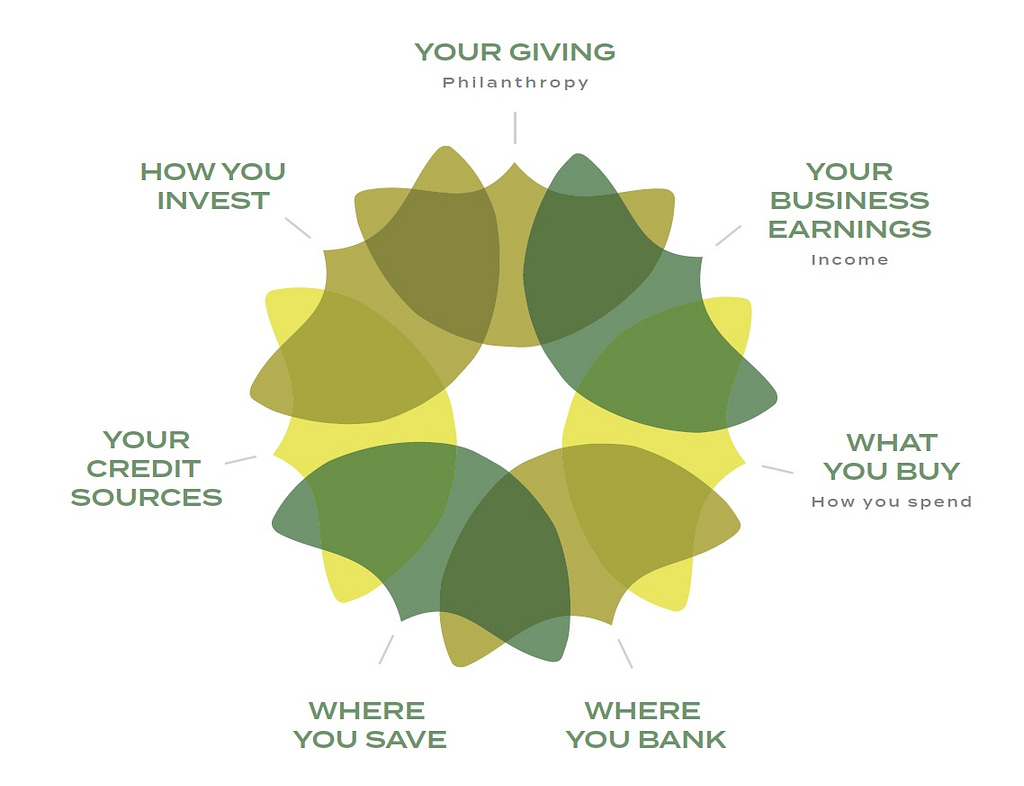

When it comes to engagement, I want to highlight some key power areas: your giving, your income, what you buy, and how you invest.

When it comes to giving, if we don’t have a vision, our actions can seem scattered—and may not bring the kind of impact we wish for. If your vision is girls’ empowerment through education, then this can guide you to connect with an organization that works toward that vision. By giving with this kind of focus, you can support impact in an area that you most care about in a more impactful and meaningful way.

Then there’s your income—how you’re earning money, and how the work that you do in the world is aligned with your values. The question might be, “What systems am I participating in and how do they generate money for me?” As an investment advisor, I’m participating in an imperfect economic system. And yet, I do deeply believe that some of us are meant to work within the system in order to transform it. And so for me, the way I earn income is aligned with my values. This exercise is not about perfection or shame. It’s about taking action for the good—even imperfect action.

Let’s move to one of the juiciest areas: what you buy and how you spend. It’s an easy one for us to think about: evaluating whether the money we spend supports things we value or don’t value. I live in Louisville, Kentucky, and grew up in the flatlands near the Ohio River in Western Kentucky, surrounded as a child by soybean fields, corn fields, and cows grazing across the way from us. Because of this early exposure to industrial agriculture, as well as my concern for the health of my hometown and the farmers’ of Kentucky, I get really excited and passionate about what it means for me to buy local, sustainable food—like the eggs at my local farmers’ market from a farmer who has ethical practices. I feel connected to our food systems and want to be part of transforming them so that local, sustainable farmers are supported, the food that I’m putting in my body is healthy, and our soil, air, and water are clean and healthy.

Where we bank is another major way we can engage our money for good. You may realize by now that big banks are hubs of power and money—and that’s putting it mildly. We put our money in them, and then they loan it to companies and corporations that we may or may not want to support. Big banks may have extractive practices globally, and they may also extract profits from communities, for the benefit of shareholders. These same considerations apply to where you save.

Another area that surprises people sometimes: credit sources. Many credit card companies direct profits toward corporations that make political contributions to issues or politicians that you may not support. I have my business credit card with a company that supports things that are in line with my values and a portion of every purchase is contributed to a nonprofit advocacy organization that works to advance clean energy, fair labor practices, and green businesses.

And finally, the one that I get most excited about: how you invest. There are some powerful ways people can connect their values to their investments. You may have inherited investments in retirement accounts or brokerage accounts. You may have saved for them through your job. Whatever the case, you can be strategic in how you’re investing by bringing your values into it.

There are so many ways you can create positive impact. I encourage you to use the diagram and the writing prompts (see below) to define your values, articulate your vision, and outline the steps you can take toward positive impact. It can be empowering and exciting. Most importantly, it can help you move from overwhelm and a feeling of paralysis to more clarity, focus, and inspired action.

WRITING PROMPTS

- I became aware of an issue/problem/concern…

- I chose to bring intention to this area of my money life because…why it matters to me…

- I got clear on what I wanted to contribute to impact/outcomes…

- I have chosen to engage and Empower my Money for GOOD by the action(s) I take…